Westminister impact on pensioner poverty revealed

For the last three decades, pensioner poverty has been falling across the UK. At its peak in 1989, 39% of pensioners had incomes below the relative poverty line of 60% of median income, after housing costs (AHC).

Westminster's most recent figures suggest that in 2009/10, around 2.1 million pensioners were living in households in which income was below the relative poverty line of 60% of median income, after housing costs (AHC). This represented 16% of a total of 11.5 million pensioners living in the UK. On 11 July 2011, the Pensions Policy Institute (PPI) launched a new report, The implications of Government policy for future levels of pensioner poverty, commissioned by Age UK, which projects future levels of pensioner poverty under the current state pension system and under a range of alternative Government policies.

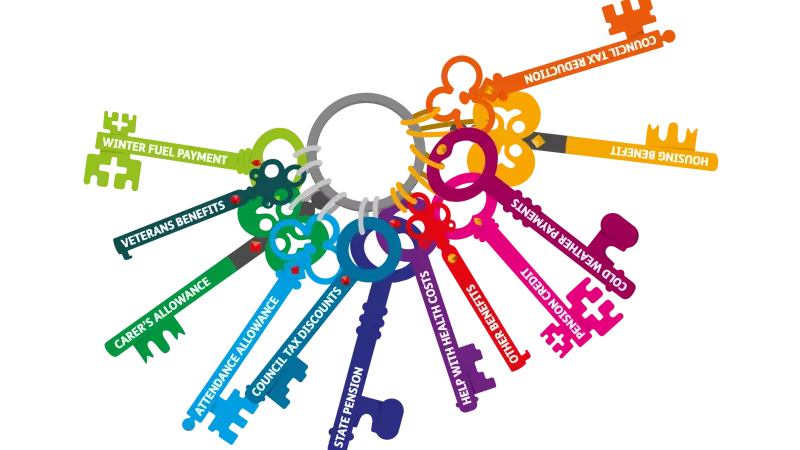

One of the key findings of the report is that decisions on the state pension and benefits paid to pensioners will determine future levels of pensioner poverty. If the UK Government was to continue with current policy - which is indexing the Guarantee Credit in line with the growth in average earnings - the percentage of pensioners living in households with household income below 60% of median income is expected to decrease to around 11% of pensioners, from around 15% in 2011.

Instead, Westminster could decide to up-rate the Guarantee Credit with the "triple lock". This involves taking the higher of three options: growth of average earnings, growth in the Consumer Prices Index or 2.5%. This is expected to result in the percentage of pensioners living in households with household income below 60% of median income to decrease to around 9%. By contrast, indexing the Guarantee Credit to growth in the CPI would increase pensioner relative poverty to around 19%.

The Government has recently been considering more radical reforms to the pension system. A flat-rate pension, as suggested in a recent Green paper, would help reduce pensioner poverty in the long term, but this is unlikely to be introduced in the near future. A single-tier pension of £140 per week in 2016 for new pensioners only is expected to reduce pensioner relative poverty to around 9% of pensioners by 2025.

However, introducing a single-tier pension for all pensioners is projected to have a larger impact. This policy would reduce the percentage of pensioners living in households with household income below 60% of median income to around 7%.

In all of these options, there is a trade-off between reducing pensioner poverty and UK Government spending. While the proposed single-tier pension for future pensioners does manage to reduce pensioner poverty without increasing spending, all of the other policy options that reduce poverty increase spending (see the table below). What's more, options that cut spending increase poverty.

So any future Government policy will need to assess the trade-off between poverty reduction and cost to the Exchequer. The research also shows that future decisions on how to index the Guarantee Credit and other benefits may have a significant impact on future pensioner poverty levels.