Blog: Benefits and pensions advice - Talk Money Week

Many older people are financially secure in later life, but others have had lives where saving for the future was impossible after they had met the costs of living day to day.

One in six pensioners in the UK is living in poverty, which affects their ability to keep their home warm, eat well, stay safe and be part of their community.

There are benefits that can help with the costs of living in later life but many older people don’t claim their due. Research shows there are key reasons why older people don’t get what they are entitled to:

a lack of information, and not knowing there are rights they can claim

concerns that it will be complicated and difficult to access entitlements

stigma – remembering the “scroungers” and “strivers and skivers” rhetoric from a few years ago

previous bad experiences of claiming benefits

feeling that they can get by as they are, as they have always coped before

a lack of trust in institutions, and concerns that they will be asked intrusive questions.

Attitudes to benefits vary; nearly everyone is happy to claim their State Pension, as they feel they have paid for it by working and paying National Insurance or by contributing to society in other ways.

Social Security Scotland is trying to change public attitudes to claiming benefits – everyone needs help sometimes.

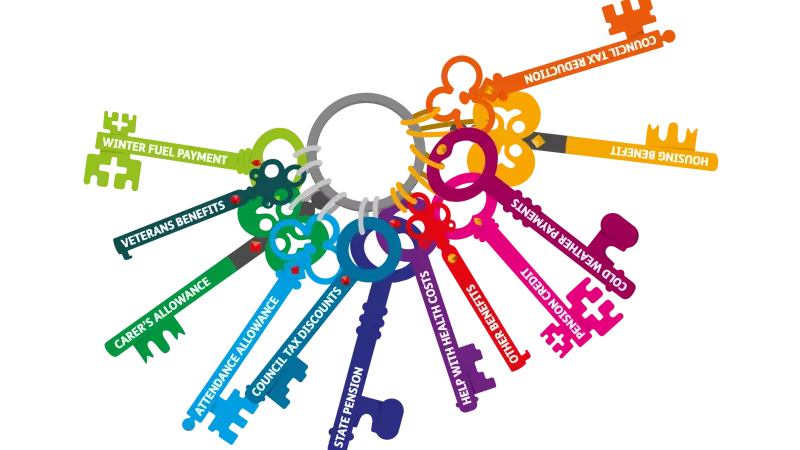

Key benefits for older people

Attendance Allowance can be claimed by anyone who needs it, regardless of their income and savings. You may qualify if you need (but don’t necessarily get) care or supervision to keep yourself safe. You can find out more here.

Help with Council Tax is available in many different ways, some means tested and others not. If you live alone you are entitled to 25% off your bill, and other discounts can be available. Many older people miss out on means-tested help with Council Tax too – try the Citizens Advice Scotland calculator here to find out if you could qualify or call our helpline on 0800 12 44 222.

Pension Credit is the main benefit for people with a low income and modest savings. Its is means tested, so you will be asked about you and your partner’s income and savings.

Pension Credit can top up your income to £173.75 (single) or £265.20 (couple) per week, and these amounts can be higher if you claim a benefit such as Attendance Allowance or Carer’s Allowance. It can passport you to other help too, including maximum help with rent and Council Tax, help with health costs, lump sum payments including Cold Weather Payments (if it is, or is due to be on average, below freezing for a week) and eligibility to claim Funeral Support Payments.

The problem with Pension Credit is that only 60% of people who are entitled to it are claiming, leaving people trying to get by on very low incomes and also missing out on help with rent, Council Tax and energy costs.

Call us on 0800 12 44 22 to find out if you’re entitled and this Talk Money Week, start that conversation with someone you think might be missing out.